Beneficial Ownership Information

Everything you need to know about the Beneficial Ownership Information (BOI) Report

You’ve probably been hearing a lot about the new reporting requirement for entrepreneurs and small business owners that went into effect January 1, 2024.

Let’s get right to it and start by clearing the air:

This is a simple, straightforward, easy report to file. It took me approximately 15 minutes from start to finish to complete. I can finish a margarita in that time, so I know this isn’t long!

HOWEVER, it is worth noting that the fees are not filing are astronomically high. We’re talking $500 PER DAY. So if you’re reading this, open up another browser and get it done now!

Below is a general FAQ so you know what this is and how (and if!) it impacts your business. If you know you need to file, you can skip down to our step by step instructions here.

WHAT IS BENEFICIAL OWNERSHIP INFORMATION REPORTING?

The BOI is a new report that is a part of the Corporate Transparency Act (CTA) . It states that certain entities are now required to report information about beneficial owners to the US Treasury’s Financial Crimes Enforcement Network (FinCEN) Department.

The short answer: It’s just a form that says who the beneficial owners are and who started the company.

WHY IS THIS A THING?

This new requirement is a part of the 2021 Corporate Transparency Act (CTA) to crack down on illegal activities, like money laundering. It aims to close the gap in knowing who owns or benefits from certain businesses in the United States. As long as you’re not committing crimes, the only thing you need to be worried about is making sure that you’ve filed the report to avoid the hefty fines for noncompliance.

The short answer: The government wants to know who exactly owns legal entities to make it easier for them to investigate crimes.

WHO IS A “BENEFICIAL OWNER”?

A beneficial owner is someone who owns more than 25% of the business or exercises substantial control over the entity. This includes owners AND officers (like CEOs, CFOs or Presidents) even if they don’t have ownership in the entity.

WHO NEEDS TO FILE?

Domestic (or foreign) Corporations, LLCs or entities formed under laws (by legally filing registration paperwork). There are several types of entities that are exempt from filing a BOI (23 to be exact!). Most notably are sole proprietorships, but the full list of exemptions can be found here.

The short answer: Most small to midsize LLCs are required to file. When in doubt, report.

WHEN IS THE BOI DUE?

This depends on when you formed your business! If you have an existing business (was formed before 2024), then you have a full year to file! If you’re a new business in 2024, then you’re required to report within 90 days of formation.

The short answer: Formed after January 1, 2024 = Within 90 days of formation.

Formed before January 1, 2024 = Due by January 1, 2025

WILL MY ACCOUNTANT FILE THIS FOR ME?

There is a chance your accountant may do this, but it is a case by case scenario. Here at The Easterday Group, we are not offering this for clients, although we are sending out several reminders to our clients so they don’t incur any fees.

WHAT DOES IT COST TO FILE?

It’s free! Yay! BUT, there are BIG TIME penalties for those that don’t file on time.

WHAT IF I DON’T FILE? OR FILE LATE?

The penalties for filing late are astronomical. The fees are $500 PER DAY, with no-cap. OUCH.

The short answer: DO NOT FILE LATE.

HOW DO I FILE?

STEP BY STEP INSTRUCTIONS FOR FILING BOI:

Step 1

Get started by heading to https://www.fincen.gov/boi

Step 2

Click File > File a report using the BIO E-Filing System > File BOIR > File Online BOIR

Step 3

When asked “The Type of Filing”, choose “Initial Report”

Step 4

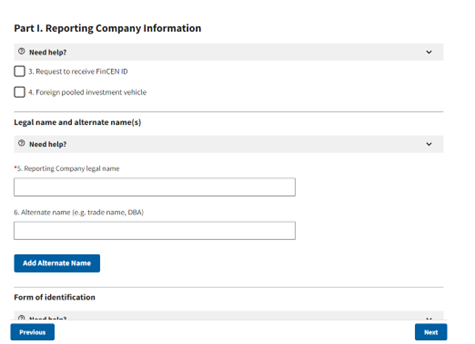

Part 1: Reporting Company Information. There are several pieces of information you’ll need, in Part 1 you’ll need:

- Legal Business Name

- DBA, if applicable

- Tax ID (EIN or SSN)

- Country of formation (United States)

- State of Formation (where your LLC was initially registered)

- Address of LLC

Step 5

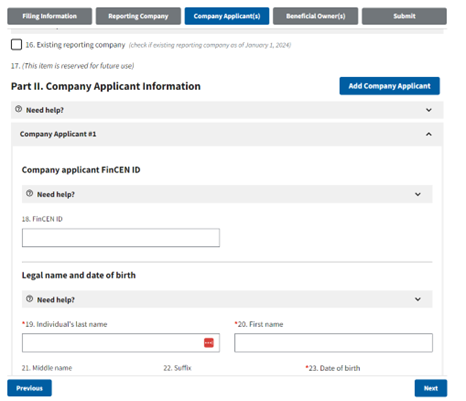

Complete Part II: Company Applicant Information. Pro tips:

- Check Box 16 if your company existing before January 1, 2024

- If your company did not exist prior to January 1, 2024, you will need to complete Boxes 17-33, and upload a copy of your Driver’s License

Step 6

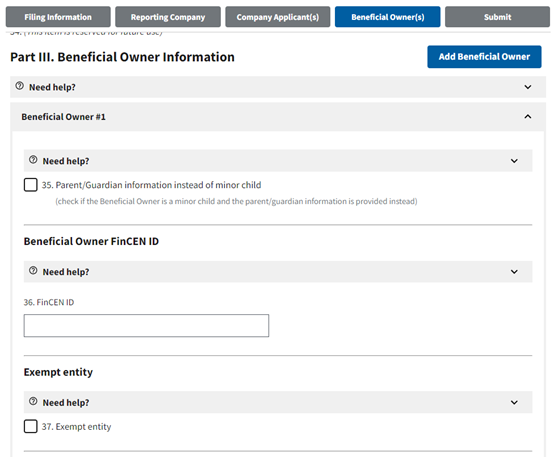

Part III: Beneficial Owner Information

- You will need to complete this section for each beneficial owner, if there is more than one!

- Information Needed, Boxes 38-51

- Legal Name

- Date of Birth

- Address

- Driver’s License (you will also need to upload a copy!) Note that my initial photo from my iPhone was too large, so I had to shrink the size of mine down in order to upload it!

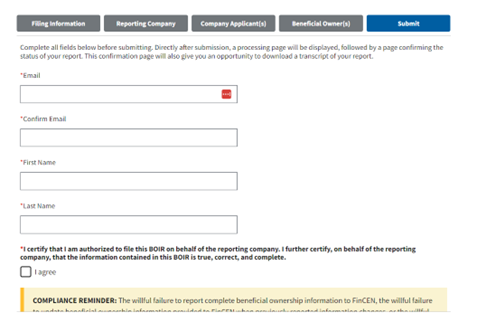

Step 7

Confirm your personal information and submit your report!

- The hardest part of this page was verifying that I was human by selecting the correct photos!

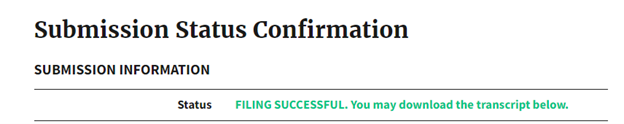

Step 8

Save a copy of your transcript for your records!