Accounting software for entrepreneurs

Quickbooks vs Honeybook vs Wave vs Freshbooks

Which is right for your business?

When it comes to choosing an accounting software, there are a sea of options. All seemingly do the same thing but with different features and prices. So, what’s the best option for you as an entrepreneur? Let’s walk through it.

WHAT IS ACCOUNTING SOFTWARE?

A good starting place, I think! Accounting software is what you use to track the revenue and expenses of your business. As you’re just getting started with your business, you may be using Excel or a Google Sheet to track your income. No shame here, but as your business grows, you’re going to need to take a deeper look into your revenue (what packages or services are bringing in the majority of your income) and your expenses (what are you spending most of your money on). This is when you’ll start to migrate towards accounting software – for things like recording incoming and outgoing payments, understanding tax payments, differentiating between expense categories, and running reports to analyze your business’s financial health.

Just starting out in your business? Download our free Business Basics guide to help you with becoming an LLC, opening a business bank account, and tracking your profit. Download for Free

OUR TOP PICKS

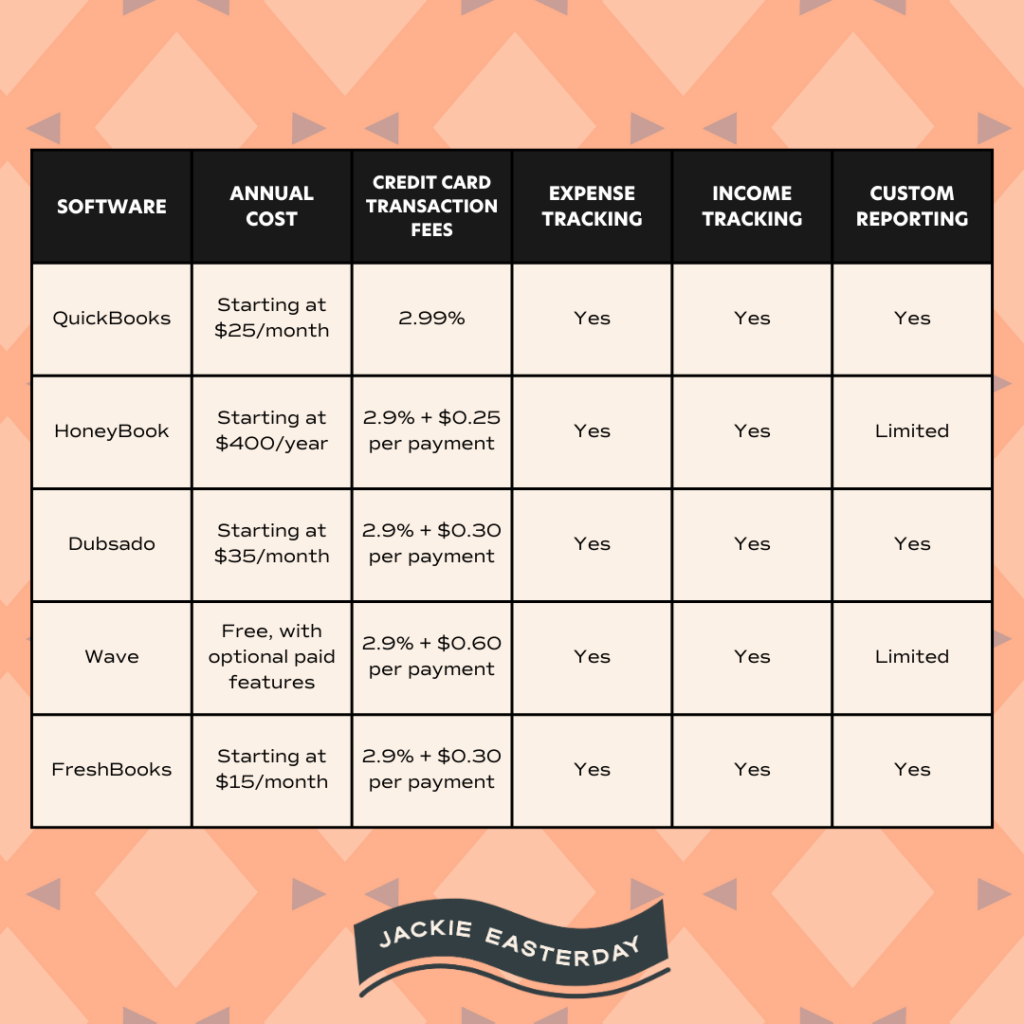

Our clients are comprised of creative and online business owners and entrepreneurs. These are our top recommendations for accounting software to use, as well as the features of each.

QUICKBOOKS

Our one true love, Quickbooks. We use this for all clients, regardless of their industry. Quickbooks is designed to be user-friendly so if you’re DIYing your accounting, you can get to know the basics pretty quickly. As you become more familiar, explore their automations which allows you to run reports and categorize recurring expenses. While many of our clients choose to use Honeybook or Dubsado for their invoicing, it’s worth noting that Quickbooks also offers invoicing and payment tracking!

Quickbooks comes in on the pricier end at $25/month + (most of our clients are on their $60/month tier), but it is by far our preferred software. It really does check all the boxes!

HONEYBOOK

While Honeybook is technically a CRM (customer relationship manager) and workflow automation platform for creative entrepreneurs, they did just recently release additional accounting and financial reporting tools.

Features include being able to connect Quickbooks to track expenses, basic financial reports to understand income and expenses, as well as some basic tax tools. Typically, though, most users are integrating Quickbooks to streamline the financial data between platforms.

Our suggestion: Use Honeybook for contracts, invoicing, and other client management needs. Use Quickbooks for accounting and financial reporting.

DUBSADO

Simliar to Honeybook, Dubsado is a CRM primarily used for client management (onboarding, project management and communication), but does have the expense and basic financial report capabilities. While Dubsado can help with basic financial tasks, you’re better off using software like Quickbooks to provide more detailed financial reporting and accounting.

At The Easterday Group, we use both Dubsado and Quickbooks! Our clients know that they’ll sign their contract, set up recurring payments, and complete onboarding questionnaires through Dubsado. They’ll also receive their end of month financial reports, walk-through videos, and link to schedule a monthly finance review call – all through Dubsado! We use QuickBooks for our accounting and reporting.

Our suggestion: Use Dubsdao for contracts, invoicing, and other client management needs. Use Quickbooks for accounting and financial reporting.

WAVE

Wave is another immensely popular accounting software used by entrepreneurs! The biggest selling point with Wave is that it is free to use, making it a very cost-effective option for small businesses and freelancers. Their basic reporting is a great starting point, but we suggest migrating to Quickbooks as it is a more scalable platform.

Our suggestion: If price is a concern, start with Wave. When you’re ready, make the switch to Quickbooks!

FRESHBOOKS

Freshbooks has a similar (or better!) ease-of-use as Quickbooks. Most users like Freshbooks for its invoicing and time-tracking capabilities. It allows users to track billable hours and send professional invoices through their platform. In addition, it has project management features like client communication and task management. Freshbooks covers your basic accounting needs, but has less robust financial reporting capabilities than Quickbooks.

Our suggestion: Both Freshbooks and Quickbooks offer free trials, so test them out! If you’re looking at DIYing your accounting, try the free trials of both to determine which you find to be more user-friendly. Keep in mind that as your business scales, you’ll likely eventually move to Quickbooks.